Press release -

February consumer spending picked up in momentum

Kevin Jenkins, UK & Ireland Managing Director at Visa commented:

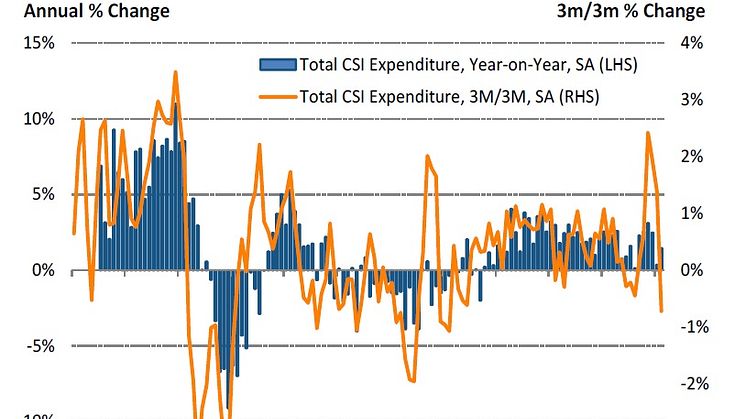

“Following a marked slowdown in January, consumer spending restored some momentum in February. Overall spend grew at an annual rate of 1.5% from a low point of 0.4% in the previous month.

“Growth in the experience sector continues to be a significant driver. Valentine’s Day and the half-term break gave consumers more reasons to dine out and treat their loved ones to short getaways around the UK. At the same time, the level of growth in the leisure and hospitality sectors was softer than we have seen in the past year, showing signs that consumers are becoming more cautious with their discretionary spending. And for clothing retailers, February was yet another challenging month, recording the biggest drop across all the sectors that we track.

“Notably, online retailers continued to enjoy strong growth, while the high street trailed behind, declining for the third month in the last four.”

What UK businesses are saying:

Visa is tracking the sentiment of several small businesses across the UK on a monthly basis, asking about their views on the economy, business conditions and forecasts for the month ahead.

Wendy Dalton, Blush Boutique, Oldham:

We had a dire start to the year. We usually see a surge in bookings, from newly engaged customers following the Christmas period, but we haven’t had that this year. Even Valentine’s day hasn’t done much to reverse this. Our customers are becoming increasingly cautious with their money, many brides are delaying their purchases, and quite a few are buying the cheaper sample dresses, instead of treating themselves to the customised options.

We are not sure whether this is due to people feeling more uncertain about their finances, but it seems that many other bridal shops are also suffering and this is clearly a growing concern for us.

Imogen Hawthorne, Paisley Immy Cakes, Birmingham:

We’ve had a steady stream of business through in February, and March is already set to be a busy month as we’ve had a number of orders in, and the challenge will be fulfilling them all. We have noticed however that the prices of our ingredients are already rising. For now, we’re keeping a close eye on prices, but if things continue at this pace we may need to shop around for different suppliers.

Tony Bailey, Top Notch Hair & Beauty, Manchester:

This hasn’t been a strong month for us, with fewer visits and lower average bills. From experience, we often have a quieter start to the year, but this year we’ve noticed that most of the high street isn’t as busy as it once was and it feels as though people are becoming more frugal. As a salon, we’re taking it one day at a time, but we are pining our hopes on business picking up next month.

Topics

Categories

Visa Inc. (NYSE:V) is a global payments technology company that connects consumers, businesses, financial institutions, and governments in more than 200 countries and territories to fast, secure and reliable electronic payments. We operate one of the world’s most advanced processing networks — VisaNet — that is capable of handling more than 65,000 transaction messages a second, with fraud protection for consumers and assured payment for merchants. Visa is not a bank and does not issue cards, extend credit or set rates and fees for consumers. Visa’s innovations, however, enable its financial institution customers to offer consumers more choices: pay now with debit, pay ahead with prepaid or pay later with credit products. For more information, visit our website (www.visaeurope.com), the Visa Vision blog (www.vision.visaeurope.com), and @VisaEuropeNews

Visa UK