Press release -

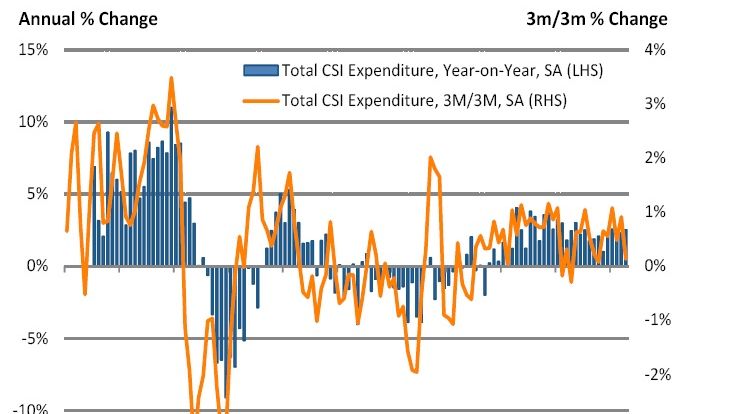

Online spending grows at fastest rate for 16 months as the experience economy powers ahead

Kevin Jenkins, UK & Ireland Managing Director Visa Europe said:

“Growth in consumables remains evident, but consumer spending is increasingly focused on the experience economy. Eating out, booking holidays and discovering new experiences are all driving spending growth at a time when the lower cost of living is creating higher disposable incomes. In a month of mostly growth, the only sector to disappoint was clothing and footwear, again highlighting this shift.

“A very strong month for online sellers suggests much of the experience economy is being driven by pre-booking of activities online. While online prospered, face-to-face spending was relatively flat, highlighting the current discussion about the future shape of the high street as well.

“Eyes will now be on May, with a sunny start to the month providing promise for the high street but also a further fillip for restaurants and hotels looking to capitalise on our desire for experiences.”

What UK businesses are saying:

Visa is tracking the sentiment of several small businesses across the UK on a monthly basis, asking about their views on the economy, business conditions and forecasts for the month ahead.

- Josh Beer, The Illustrious Pub Company, Cambridgeshire: Easter falling in March coupled with an especially cold and rainy start to the month meant we had a quieter April than expected. With that said, towards the end of the month we started to see an uplift in lunchtime sales, perhaps due to the warmer weather which came with the start of spring. With the new living wage coming into effect, and the start of summer, we expect increased sales in the coming months

- Gayle Haddock, Carry Me Home children’s clothes, London: April was actually quite a good month for us. The cold weather helped us to sell some winter pieces and drew more customers towards the discounted mid-season sale items. Our Online sales in particular have surged, as more regulars take to our website to quickly get hold of the items they’re after. Social media partnerships with parent and toddler groups and online competitions have also helped to increase our online presence and have allowed us to reach customers further afield.

- Quan Nguyen, Chi Cafe, London: Despite the bad weather, we had a rather good month in April. The surprisingly cold and wet start to the month seemed to have prompted people to spend more on comforting meals at lunch time, with our hot spicy noodle soup range doing particularly well. At the same time, we are working on a new summer salad range to entice customers when the weather brightens up. With people increasingly looking for healthy lunch options, we hope our sales will grow steadily over the summer.

Topics

Categories

Visa Europe is a payments technology business

owned and operated by member banks and other

About Visa Europe

Visa Europe is a payments technology business owned and operated by member banks and other payment service providers from 38 countries.

Visa Europe is at the heart of the payments ecosystem providing the services and infrastructure to enable millions of European consumers, businesses and governments to make electronic payments. Its members are responsible for issuing cards, signing up retailers and deciding cardholder and retailer fees. Visa Europe is also the largest transaction processor in Europe, responsible for processing more than 18 billion transactions annually.

There are more than 500m Visa cards in Europe, while €1 in every €6 spent in Europe is on a Visa card. Total expenditure on Visa cards exceeds €2 trillion annually, with €1.5 trillion spent at point-of-sale.

Visa Europe is an independent business with an exclusive, irrevocable and perpetual licence to use the Visa brand in Europe. Visa Europe works in partnership with Visa Inc. to enable global Visa payments in more than 200 countries and territories.

For more information, visit www.visaeurope.com and @VisaEuropeNews

Visa UK